The Best Strategy To Use For Guided Wealth Management

The Best Strategy To Use For Guided Wealth Management

Blog Article

Not known Factual Statements About Guided Wealth Management

Table of ContentsThe 15-Second Trick For Guided Wealth ManagementThe Ultimate Guide To Guided Wealth ManagementSome Known Factual Statements About Guided Wealth Management Not known Factual Statements About Guided Wealth Management The Best Guide To Guided Wealth Management

For investments, make payments payable to the item provider (not your adviser). Offering a financial adviser complete accessibility to your account raises risk.If you're paying an ongoing advice charge, your adviser should evaluate your financial scenario and consult with you at the very least yearly. At this conference, see to it you review: any modifications to your objectives, situation or financial resources (consisting of changes to your income, costs or possessions) whether the level of threat you fit with has altered whether your current personal insurance coverage cover is best exactly how you're tracking versus your objectives whether any type of modifications to legislations or monetary items could affect you whether you have actually received every little thing they guaranteed in your agreement with them whether you require any type of adjustments to your plan Yearly an adviser should seek your created grant bill you recurring advice costs.

This may occur during the conference or electronically. When you get in or renew the recurring cost setup with your consultant, they ought to explain just how to finish your relationship with them. If you're transferring to a brand-new advisor, you'll need to arrange to move your economic documents to them. If you need help, ask your adviser to discuss the procedure.

Guided Wealth Management Can Be Fun For Everyone

As an entrepreneur or small service proprietor, you have a whole lot taking place. There are lots of responsibilities and expenses in running an organization and you definitely don't require one more unneeded bill to pay. You require to very carefully think about the roi of any services you obtain to make certain they are beneficial to you and your service.

If you're one of them, you might be taking a huge threat for the future of your service and yourself. You may intend to continue reading for a list of reasons that employing a monetary consultant is useful to you and your organization. Running an organization has lots of challenges.

Money mismanagement, cash flow troubles, delinquent settlements, tax obligation issues and other monetary issues can be critical sufficient to close an organization down. There are several methods that a qualified economic consultant can be your companion in assisting your service thrive.

They can collaborate with you in reviewing your monetary situation often to prevent significant blunders and to quickly deal with any poor cash choices. see this A lot of small company proprietors use many hats. It's reasonable that you want to save cash by doing some jobs on your own, but taking care of funds takes understanding and training.

Rumored Buzz on Guided Wealth Management

You need it to recognize where you're going, exactly how you're getting there, and what to do if there are bumps in the road. An excellent economic consultant can place together a detailed strategy to assist you run your service more successfully and prepare for abnormalities that arise.

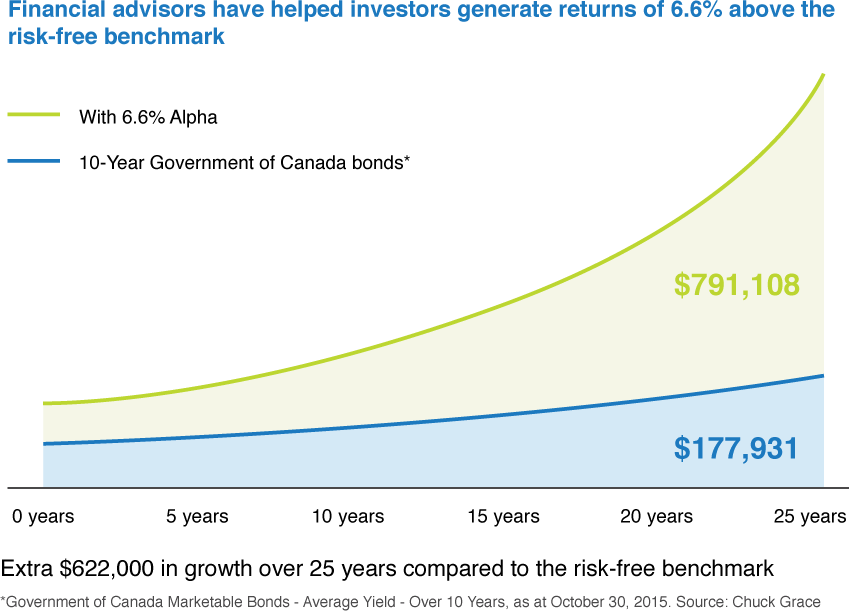

A reputable and well-informed financial advisor can lead you on the financial investments that are appropriate for your business. Cash Cost savings Although you'll be paying a financial advisor, the long-term financial savings will certainly warrant the price.

Minimized Tension As an organization owner, you have lots of things to worry about. A good financial consultant can bring you tranquility of mind knowing that your financial resources are obtaining the focus they require and your cash is being invested intelligently.

Guided Wealth Management Can Be Fun For Everyone

Stability and Development A competent financial advisor can provide you clarity and aid you concentrate on taking your organization in the appropriate instructions. They have the tools and resources to utilize techniques that will guarantee your business expands and flourishes. They can assist you evaluate your objectives and identify the very best path to reach them.

8 Easy Facts About Guided Wealth Management Shown

At Nolan Accountancy Facility, we offer know-how in all aspects of financial preparation for small services. As a local business ourselves, we recognize the difficulties you deal with daily. Provide us a telephone call today to go over how we can aid your organization grow and be successful.

Independent possession of the practice Independent control of the AFSL; and Independent pay, from the customer just, using a fixed dollar charge. (https://letterboxd.com/guidedwealthm/)

There are various advantages of a financial planner, despite your circumstance. However despite this it's not uncommon for people to 2nd guess their suitability because of their placement or existing financial investments. The purpose of this blog is to show why everyone can gain from a monetary plan. Some usual issues you might have felt on your own include: Whilst it is simple to see why individuals might think this means, it is certainly wrong to regard them fix.

Report this page